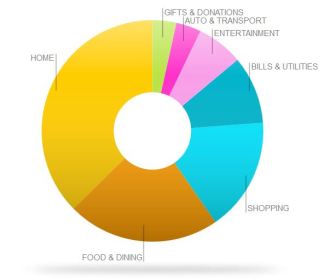

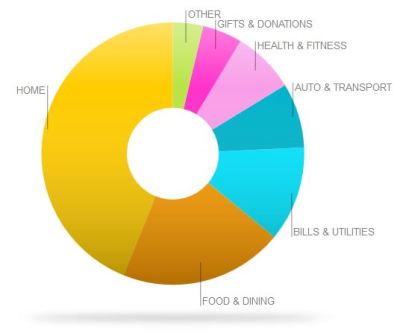

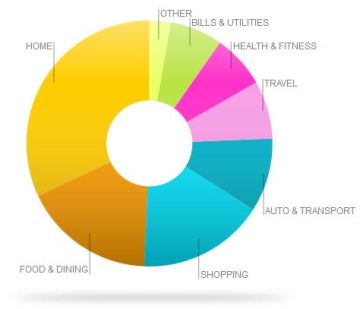

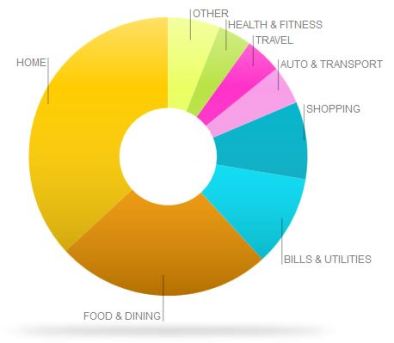

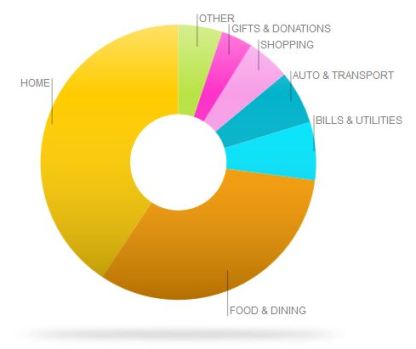

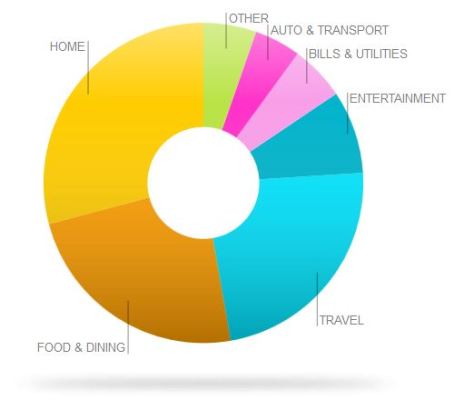

From my recurring income series; Our net savings / spending numbers for June 2016:

From my recurring income series; Our net savings / spending numbers for June 2016:

We had our usual rental income and received 3 paychecks each, so a lot of income. With our reasonable spending we hit a total savings rate of 88%.

That is an all time high! Hopefully we can move more in that direction going forward. We’ve seen a good trend of income steadily rising while spending has been flat. Then hopefully in a few years the house will be paid off, although only about 2/3 of that “Home” spending is the interest payment I count as an expense, taxes and insurance won’t go away.

Income will be back to average in July due to 2 paychecks, and spending low to average, so I’ll set a saving goal of 80%.